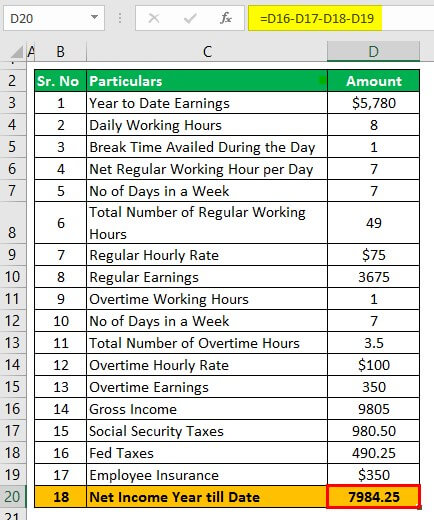

Paycheck calculator with health insurance deductions

This Paycheck Calculator can be used as a paycheck calculator Texas and other States can be used to estimate the actual paycheck amount brought home after taxes and deductions from. 2000 300 1700 After deducting the health insurance premiums the employees pay is.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

. Health Insurance POP etc. Other money deducted from your paycheck depends on whether you opt to take advantage of benefits offered by your employer. Say Ricky earns 1000 per pay period in gross wages earnings before paycheck deductions.

He contributes 30 per pay period for health insurance costs. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. You can enter your current payroll information and deductions and then.

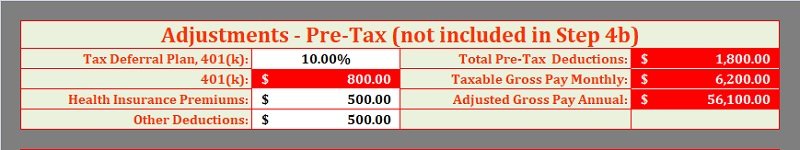

Paycheck Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Payroll Deductions Calculator Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. As an example you could not deduct your premiums in 2020 if your AGI was 60000 and you paid.

So before withholding any taxes deduct 300 for the pre-tax health insurance. You can enter your current payroll. Ad See the Paycheck Tools your competitors are already using - Start Now.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Hourly Paycheck and Payroll Calculator Need help calculating paychecks. To complicate matters the cost of the.

Heres a step-by-step guide to walk you through. You can include these in the deduction to help you get over the 75 threshold. Lets say that you now offer health insurance and have decided to pay for 50 of the cost.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. You can include these in the deduction to help you get over the 75 threshold. As an example you could not deduct your premiums in 2020 if your AGI was 60000 and you.

Read reviews on the premier Paycheck Tools in the industry. If you have health or life insurance plans through your. Payroll Deductions for Employee Benefits Health Insurance.

Read reviews on the premier Paycheck Tools in the industry. For example if you earn 2000week your annual income is calculated by. Ad See the Paycheck Tools your competitors are already using - Start Now.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. It can also be used to help fill steps 3.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Template Download Printable Pdf Templateroller

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Step By Step With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Step By Step With Examples

Ready To Use Paycheck Calculator Excel Template Msofficegeek

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Paycheck Calculator Online For Per Pay Period Create W 4

Net Pay Definition And How To Calculate Business Terms

Free 12 Paycheck Calculator Samples Templates In Excel Pdf